Minimum Wage Increases Add to Small Business Costs

Small and medium-sized businesses, notably in high cost and heavily regulated states like Connecticut, operate on thin margins.

Every cent matters and every additional cost takes away from reinvestment into a business and its employees.

While some larger corporations can absorb cost increases and the unpredictability of compliance changes, the impact is often significant for small and medium sized businesses, forcing changes operations, workforce development, and employee investments.

With Connecticut’s most recent indexed 3.6% increase to $16.94—fifth highest in the country and notably higher than most neighboring states—small and medium sized businesses will inevitably face difficult workforce and operational decisions.

CNBC’s America’s Top States for Business ranked Connecticut’s cost of doing business—a perennial drag on the state’s competitiveness—the seventh highest in the country this year.

Rising Business Costs

Concerns over the cost of doing business in Connecticut have only intensified in recent years.

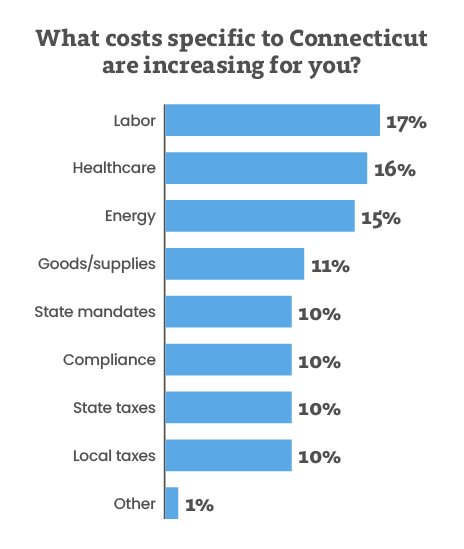

Regulatory mandates, tax policies, energy costs, and broader economic pressures are significantly impacting operating costs for businesses across the state.

The CBIA/CBIZ 2025 Survey of Connecticut Businesses found that 91% of businesses——a five point increase over the previous year—reported the cost of doing business is rising, driven by labor, healthcare, energy, taxes, and compliance costs.

Most firms CBIA surveyed were small businesses, with 68% employing less than 50 people and 13% employing 50 to 99 employees.

Costs issues contributed to business leaders’ outlook for the state’s economy, with 48% projecting static conditions over the next 12 months, with 23% forecasting growth and 20% a contraction.

That contrasts with the outlook for the national economy, with 40% expecting growth, 27% a contraction, and 20% no growth.

Lost Opportunities

Raising the minimum wage is a well-intended way of providing entry level and lower-skilled workers with more financial opportunities.

However, a regularly indexed increase that continues driving up labor costs has unintended consequences—including suppressing job growth.

A regularly indexed increase that continues driving up labor costs has unintended consequences.

Businesses such as those in the service or construction industry hire entry-level employees for tasks that require minimal experience but offer the opportunity to grow in a role and climb the ladder within the company or elsewhere.

At a higher wage, these positions may no longer be financially viable, hiring may slow, and increasing the wages of long-standing and tenured employees with more experience becomes less likely.

For instance, a Congressional Budget Office study estimated that a federal minimum wage increase to $15 per hour could lead to a loss of nearly 1.5 million jobs nationwide.

Economic Impact

One thing that everyone can agree on is that when costs increase for businesses, it’s inevitably passed on to consumers.

We’re seeing it in real time at the federal level with the unpredictability of tariffs.

Policymakers must look for solutions that balance fair wages with economic sustainability.

Businesses are either holding onto capital for better spending power when predictability resurfaces, have preordered in bulk to avoid a rise in costs for regularly purchased goods, or are simply passing on increasing costs to consumers.

For small businesses, already dealing with tight margins and a rapidly changing economy, indexed wage increases only compound the challenges they face.

Policymakers must look for solutions that balance fair wages with economic sustainability, including industry targeted tax incentives for small businesses, enhanced workforce development investments, more cohesive employer to educational institution engagement, and measures that address the high cost of living and doing business in Connecticut.

For more information, contact CBIA’s Paul Amarone (860.244.1978).

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.