Federal Overtime Salary Threshold—What’s the Right Level?

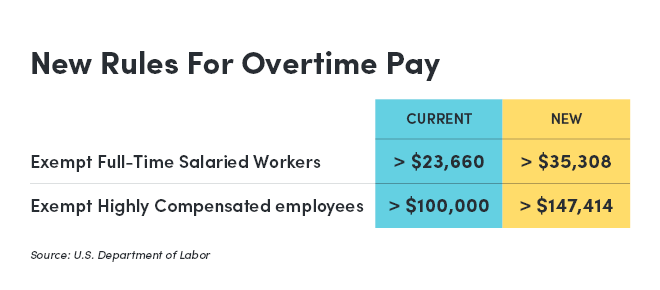

Since 2004, the salary threshold for so-called white-collar exemptions has been $23,660.

Republicans and Democrats agree—it’s time for that threshold to be raised. The question is, how much?

Under the Fair Labor Standards Act, nonexempt workers must be paid one-and-one-half times their regular rate of pay for time worked over 40 hours a week.

To be exempt from overtime, workers must be paid a minimum amount (currently under $23,660) and meet certain work duty tests.

In March, the Department of Labor signaled plans to raise the salary threshold to $35,308.

This would bring the threshold to a midway point between the current level and the $47,476 level approved by the Obama administration in 2016.

Work Duty Tests

According to some legal experts and a federal Judge in Texas, the Obama administration threshold would make the work duty tests irrelevant.

In the court’s view, the minimum salary level is meant simply to serve as a screen to eliminate clearly nonexempt employees.

As a reminder, the parameters of work duty tests follows:

- Executive Exemption. The employee’s primary duty must be managing the enterprise or a department or subdivision of the enterprise. The employee must customarily and regularly direct the work of at least two employees and have the authority to hire or fire workers (or the employee’s suggestions and recommendations as to hiring, firing, or changing the status of other employees must be given particular weight).

- Administrative Exemption. The employee’s primary duty must be performing office or nonmanual work that is directly related to the management or general business operations of the employer or the employer’s customers. The employee’s primary duty also must include the exercise of discretion and independent judgment concerning matters of significance.

- Professional Exemption. The employee’s primary duty must be to perform work requiring advanced knowledge in a field of science or learning that is customarily acquired by prolonged, specialized, intellectual instruction and study.

Formula Dispute

In 2004, the Department of Labor set the salary threshold based on the 20th percentile of earnings for salaried workers in the lowest-wage region in the country or in the retail sector nationwide.

That formula is the same one used by the Trump Administration in its latest recommendation.

The Society for Human Resource Management and a number of Republicans agree with the Trump Administration’s use of the 2004 formula.

However, a significant number of Democrats disagree—siding with Rep. Mark Takano (D-California), who opposes the $35,000 threshold as too low and calling the proposal “woefully inadequate.”

According to Takano, the DOL’s “new overtime salary threshold ignores the economic realities middle-class workers are facing across the country.”

Takano and other Democrats recently reintroduced the Restoring Overtime Pay Act to codify the Obama administration’s 2016 overtime rule.

How will it all turn out? Stay tuned!

About the author: Jennifer Dixon is a partner at the labor and employment law firm Kainen, Escalera & McHale in Hartford.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.