Cost Concerns Doom One Paid FMLA Bill, Another Survives

A pair of identical paid family and medical leave mandate proposals met different fates April 17 in the General Assembly’s Finance, Revenue and Bonding Committee.

A Senate bill failed while a House measure passed by a single vote after promises were made to change how the mandate’s implementation costs will be funded.

However, state Rep. Patricia Billie Miller (D-Stamford), chair of the Finance Committee’s bonding subcommittee, noted Connecticut’s borrowing was approaching the legislature’s self-imposed cap.

That meant the state would have to set aside other important projects to fund the mandate.

Miller joined all committee Republicans in voting against SB 1, which failed on a 25-26 vote.

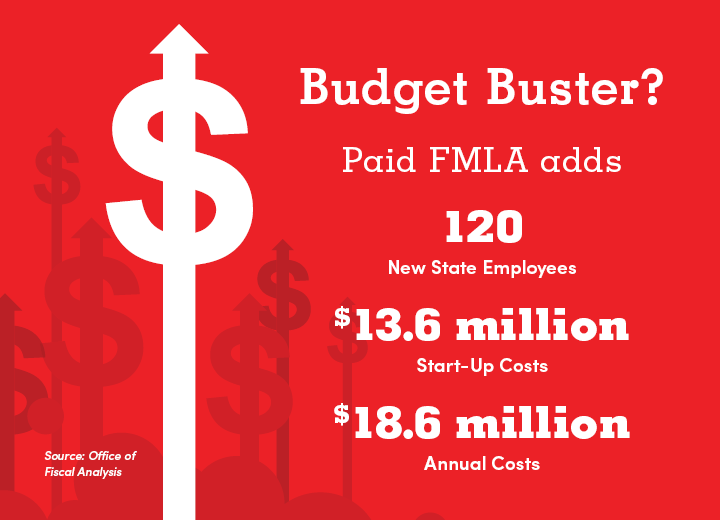

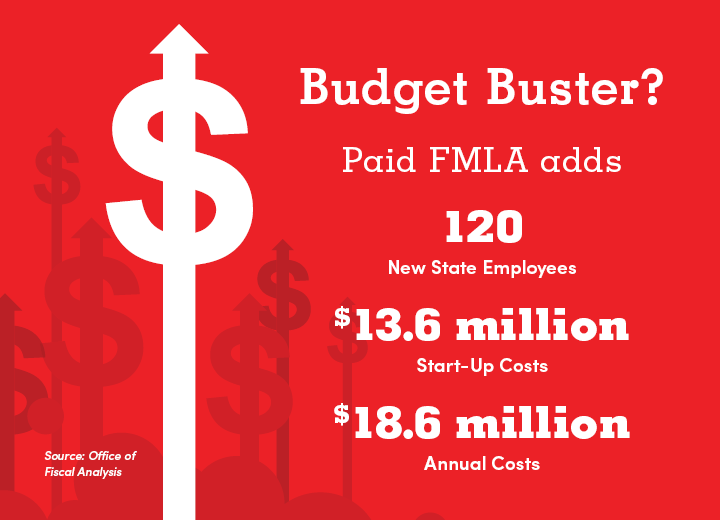

Taxpayers Foot the Bill

House Democratic leadership, learning that a key legislative priority was at risk, descended on the committee hearing, and a long conversation with Miller followed.

Miller then told the committee that while she would not change her vote against SB 1, she had received assurances the bonding language would be stripped from HB 5387 at a later date.

She said she was told funding for the FMLA program’s startup costs would instead come from the state’s General Fund.

Whether paid FMLA's start-up costs are funded through bonding or the General Fund, taxpayers will foot the bill.

The committee passed HB 5387 on a 26-25 party-line vote. While it survived the committee vote, the bill faces additional hurdles.

'Do As I Say'

Democratic leadership, keenly aware of the program's huge price tag, is now determining how to pay the implementation costs.

However, the bill takes a "do as I say, not as I do" approach to paid FMLA by exempting state and municipal workers from the mandate.

That leaves the private sector to carry the burden.

Remember, this costly paid FMLA mandate applies to businesses with as few as two employees.

Paid leave benefits will be funded through mandatory deductions from employee wages, but businesses are required to continue paying nonwage benefits during absences.

In addition, this proposal allows the use of paid FMLA to not only care for extended family members—including siblings, grandparents, and grandchildren—but also "anyone whose close association with the employee is equivalent to that of a family member."

HB 5387 awaits action in the state House.

For more information, contact CBIA's Eric Gjede (860.480.1784) | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.