Can COVID-19 Relief Funds Resolve Unemployment Debt Crisis?

While the pandemic has caused unprecedented change to many Connecticut businesses, the resulting long-term consequences and the significant drain on the state’s Unemployment Compensation Trust Fund is all too familiar.

While it seems like ancient history, Connecticut borrowed more than $1 billion from the federal government to maintain the solvency of the unemployment trust fund during the 2008-2009 recession.

Employers were solely responsible for repaying this debt. As a result of the unpaid balance, the federal government increased the interest that businesses paid on the loan each year.

In addition, employers were charged special assessments each August to pay down the interest on the loan. At one point, Connecticut businesses paid four times the federal unemployment taxes levied on employers in neighboring states.

These increased taxes and assessments put a financial strain on many businesses that prolonged the economic downturn and resulted in less hiring and growth in the state.

After six years of increased taxes and assessments, employers finally repaid the loan. Connecticut was one of the last states to satisfy its debt.

New Debt Looms

Realizing increased federal unemployment taxes on businesses were preventing growth, several states transferred money from their general funds to aid employers with their debt obligations.

Connecticut, however, chose not to help. Policymakers also ignored calls for much-needed reforms to the unemployment system to prevent future insolvency crises and the subsequent impact on employers.

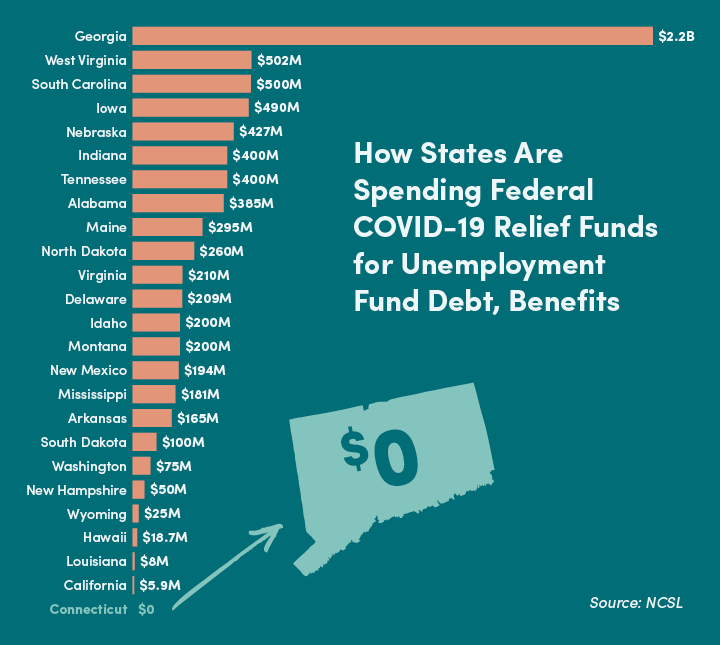

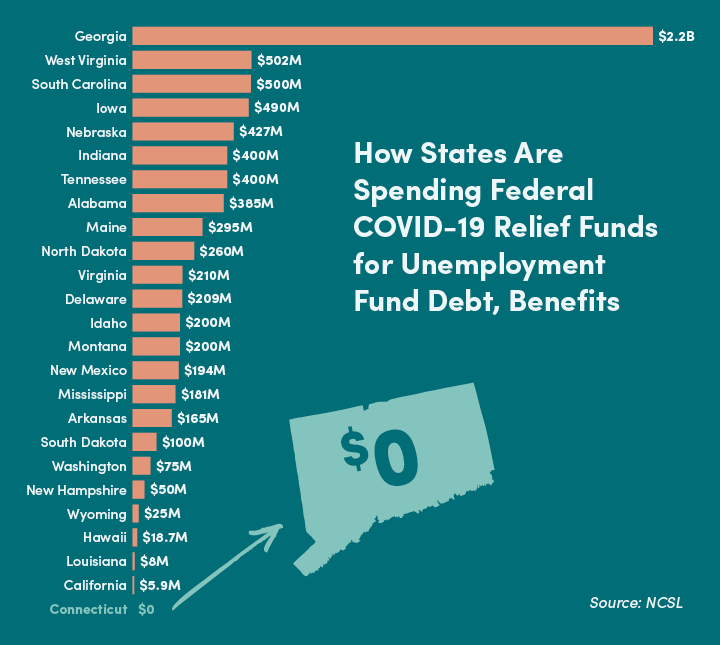

To date, 24 states have used portions of federal coronavirus relief funds to either help pay for unemployment benefits or pay down the principal on their federal loans.

Here we are again. To date, Connecticut has borrowed more than $600 million from the federal government so the state can continue paying benefits to the hundreds of thousands .

Long after the public health emergency is over, Connecticut employers will be repaying this massive loan.

Numerous other states are acting to prevent such a crisis. To date, 24 states have used portions of their federal coronavirus relief funds to either help pay for unemployment benefits or pay down the principal on their federal loans.

Federal Relief Funds

Connecticut has not used a single dollar to help with unemployment, despite additional funds being recently promised in the American Rescue Plan Act and our own state tax revenues exceeding projections.

Further, state policymakers borrowed from the fund during the recession, an unprecedented move regardless of whether intentions were laudable.

This is unfortunate as the use of these funds will benefit every business in every lawmakers’ district in the state.

HB 5607, a bill that recently had a public hearing in the General Assembly’s Appropriations Committee, aims to address this critical issue.

While the proposal was put forward by a number of House Republicans, it appeared to attract bipartisan interest during the March 26 hearing. This could be welcome news to the business community, still very much feeling the pain of COVID-19 restrictions and disruptions.

CBIA’s Eric Gjede notes that Connecticut was one of just a few states that never recovered all jobs lost during the 2008-2010 recession, with the burden placed on Connecticut employers to pay down federal loan debt one of the factors behind that failure.

“Absent federal relief dollars, businesses in Connecticut will be paying down this debt for many years to come—again hindering our ability to recover and grow jobs,” Gjede told Appropriations Committee members.

Reforms

While HB 5607 is critical in the short term, more reforms are needed to provide short-term relief and stabilize the unemployment fund for the long term, including:

- Supporting HB 5377, which prevents and employer’s state unemployment tax experience rating from being impacted by COVID-19 related layoffs.

- Opposing HB 6633 as currently written. This bill will significantly increase unemployment taxes on employers. The bill contains some minimal benefit reforms but is in no way a balanced approach to maintaining solvency of the unemployment trust fund.

CBIA has repeatedly offered its willingness to have an honest conversation about whether the state is appropriately spending funds provided by the business community for the unemployment safety net.

The business community’s goal is to achieve a healthy unemployment trust fund for workers who become unemployed in the future.

We can do so without crippling tax increases. HB 5607 will shield employers from debilitating long-term debt so that they can get back to helping restore and rebuild our state’s economy.

For more information, contact CBIA’s Eric Gjede (860.480.1784) | @egjede.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.