CEOs Air Concerns with State-Run Healthcare Expansion, Tax Hike

The chief executives of five of Connecticut’s largest insurance companies sent a letter to Gov. Ned Lamont April 13 expressing concerns with legislation expanding state-run healthcare and imposing a new tax on policyholders.

“The pandemic has demonstrated that employees can work virtually, making it easier for companies to choose where they are domiciled and grow,” the executives wrote in the letter.

“As a result, it has never been more critical for the state to create a climate that retains and attracts businesses that will help stabilize the economy. All of us will have to decide where it will be best to deploy our resources long term.

“Private employers and taxpayers should not fund unsustainable public policy pursuits.”

Signed by the CEOs of Anthem, Cigna, CVS Health, Harvard Pilgrim HealthCare, and UnitedHealth Group, the letter warned that passage of SB 842—which expands state-run healthcare—”will only further deteriorate the state’s fragile economy.”

Fiscal Health Questions

In February, CBIA called for an independent audit to address the significant questions surrounding the fiscal health of the state’s municipal plan—known as the State Partnership Plan—which is the model for SB 842.

State Comptroller Kevin Lembo, a leading advocate for expanding state-run healthcare, manages the partnership plan. He has yet to respond to the audit request.

“The State Partnership Plan does not have the proven experience to run a health insurance program for its residents,” the letter signed by the executives notes.

“The state comptroller administered the partnership program at a shortfall of $10 million in 2018 and $31 million in 2019.

“Taking from one pot of money to cover a deficit in another is not sound fiscal policy.”

April 13 CEO letter

“The argument put forth attempts to argue the partnership program is solvent and successful; we would argue that taking from one pot of money to cover a deficit in another is not sound fiscal policy.

“Continuing on this path will only further deteriorate the state’s fragile economy.”

CBIA’s call for an audit cited the latest detailed and concerning analysis of the plan’s fiscal outlook produced by the insurance agency Brown & Brown.

The agency has a large number of clients enrolled in the municipal plan. Brown & Brown officials are concerned with the plan’s unregulated status and believe greater oversight is needed to ensure its fiscal health.

Tax Hike

In the letter to Lamont and legislative leaders, the insurance company CEOs also addressed a proposed tax hike—modeled on a now repealed federal tax—that will drive up healthcare costs for employers and families.

The $50 million tax on healthcare polices included in SB 842 and HB 6447 is designed to fund additional premium subsidies for policies issued by the state-run healthcare exchange.

The executives argued that the federal American Rescue Plan Act, signed into law March 11, provides the premium relief sought by both bills without raising taxes on small businesses and residents.

“The state should not attempt to lower the cost of insurance for some by imposing significant new taxes on others.”

CEO letter

“While we believe your intent is one we share—to bolster the state’s health exchange, Access Health CT—we firmly believe that state and newly passed federal funding can and should be used for this purpose—not a new tax on policyholders,” the letter notes.

“Residents are already paying over $100 million in health insurance taxes to the state. The state should not attempt to lower the cost of insurance for some by imposing significant new taxes on others that will inevitably be passed along to policyholders in the form of higher premiums.”

Innovation

A recent independent report showed that the 2019 repeal of the federal tax on insurance policies will reduce premiums by more than $270 billion over the next 10 years.

The health insurance executives also referenced Lamont’s call for private sector innovation to address rising healthcare costs and to support small businesses.

“You rightly called upon the private market to continue innovating and providing more choices for some of our struggling small employers,” the letter read. “We have done just that. There are now a number of offerings with new products in the market.

The 2019 repeal of the federal tax on insurance policies will reduce premiums by more than $270 billion over 10 years.

“To allow carriers to innovate and further compete, the administration and the legislature should explore updating the current legal and regulatory framework to allow for maximum flexibility.

“We look to you to provide leadership and focus on proposals that will provide much-needed stability and support.

“As companies committed to the people and communities of Connecticut, we look forward to working with you, your administration, and the legislature to find ways to build a sustainable, affordable and more accessible health system for the people we are privileged to serve.”

Economic Impact

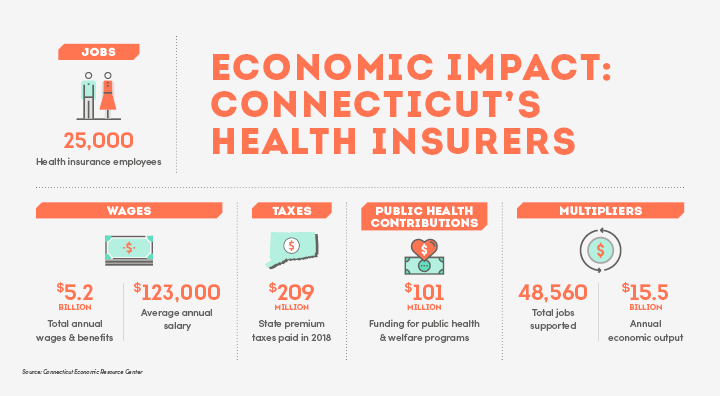

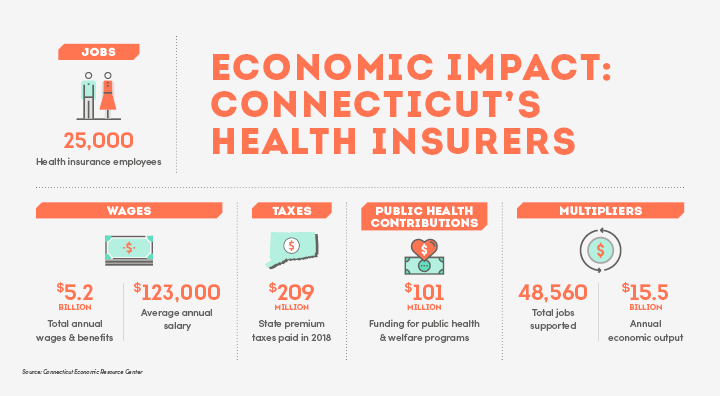

According to a 2019 study produced by the Connecticut Economic Resource Center, the health insurance industry employs 25,058 workers and supports another 23,000-plus additional jobs in ancillary industries.

The study found that industry employers pay $5.2 billion in wages and benefits annually, with an average salary of $123,000.

Connecticut’s health insurance industry employs 25,058 workers and supports another 23,000-plus additional jobs.

The industry also generates $15.5 billion in annual economic activity, pays over $209 million in state taxes, and provides $101 million in funding for public health and welfare programs.

The CERC report estimated that even a 10% decline in the state’s health insurance industry would lead to a loss of some 5,000 jobs and $1.6 billion in economic output.

A decline of 25% to 50% would lead to a loss of 12,000 to 24,000 jobs and $4 billion to $8 billion in economic output.

For more information, contact CBIA’s Wyatt Bosworth (860.244.1155) | @WyattBosworthCT.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.