Paid FMLA Mandates: ‘Do As I Say, Not As I Do’

One key exemption included in a pair of paid family and medical leave proposals provides all the evidence Connecticut lawmakers need to vote against these costly new mandates.

Advocates say businesses have “a moral responsibility” to provide the benefit to their employees, yet the public sector is exempted from both bills, with state and local government workers left behind.

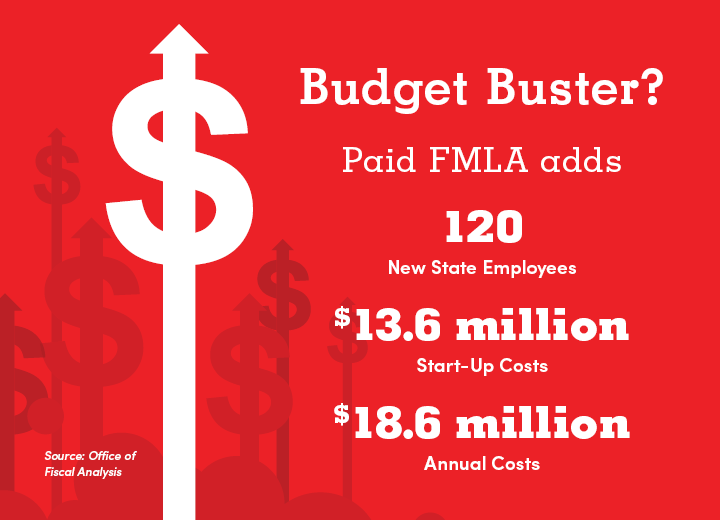

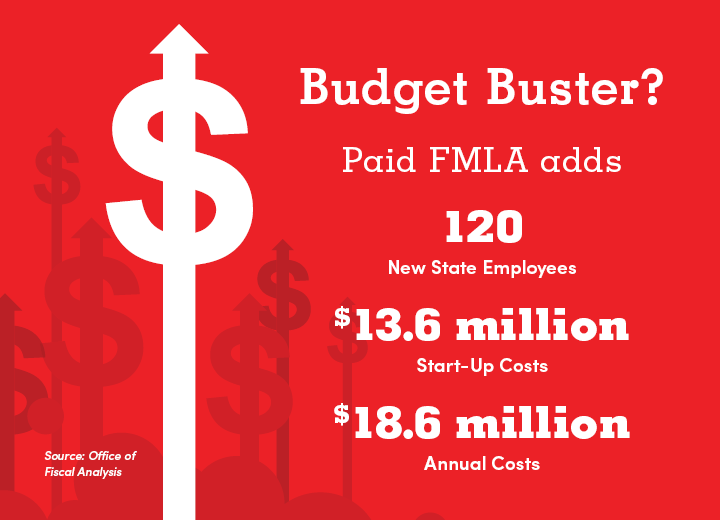

Taxpayers will be saddled with the start-up costs for Connecticut’s proposed paid FMLA mandate.

Last year, a similar proposal was rejected, largely based on an analysis that the program would cost $13.6 million to implement and another $18.6 million annually in administrative costs.

This year’s bills call for $20 million in bonding to pay for the program’s start-up costs, saddling taxpayers with the bill and adding to the state’s ever-growing debt obligations.

Faulty Math

Further digging reveals that like their predecessors, the two proposed paid FMLA measures are not only costly to implement and administer, but their structures are based on faulty math, making them completely unsustainable.

Under both, the state takes a percentage of employee wages for deposit into a fund. That fund then covers employees with up to 12 weeks of paid leave at 100% of their pay, capped at $1,000 per week.

Advocates argue that only 0.5% of a worker’s pay will be needed to fund this new program. This means a person earning $52,000 a year contributes just $260 per year into the fund, yet would be eligible to take out $12,000 each year.

Or to put it another way, paying the maximum leave benefits for one employee requires the full annual contributions of 47 other workers.

By that accounting, the paid FMLA fund faces almost immediate insolvency.

No Guaranteed Benefits

Paid FMLA legislative supporters know this. So, how do they propose to address it?

The state Department of Labor will have the responsibility of administering paid FMLA if it becomes law. If department staffers—and remember, their employer is exempt from the mandate—determine there isn’t enough money in the fund, they will then just cut weekly benefits to workers.

That means while all Connecticut private sector employees will be forced to pay into this fund, there’s no guarantee as to what actual paid benefits they will receive.

Inflexible, intrusive mandates are not practical in the modern workplace. Fewer and fewer employees work traditional work weeks. Many businesses are already offering flexible work hours or options like telecommuting.

Why did lawmakers exempt the public sector from the paid FMLA mandate? The price tag.

According to a 2016 CBIA survey of Connecticut businesses, 54% of companies added additional flexibility to their leave policies over the last five years to accommodate employees.

As the conversation continues, and the issue becomes front and center on election campaign trails later this year, remember to question the details.

Unfortunately, mandates often ultimately hurt those they are designed to help. Connecticut's paid FMLA proposals are no exception.

Hurt Small Businesses

Not to mention that restrictive, unsustainable mandates often drive employers—particularly small businesses—to the point that they are forced to raise prices, cut hours, or lay people off.

As numerous state rankings show, operating a business in Connecticut is all too often costlier than running the same business in other states. With each additional workplace mandate, the cost divide between Connecticut and other states increases.

A far better approach to spur much-needed growth is passing legislation like HB 5584, which provides a tax credit for employers that have paid family and medical leave benefit programs.

Mandates like paid FMLA, however, only tilt the playing field against Connecticut to other states—typically ones that are not burdening their businesses with new, costly burdens.

Workplace costs are as much a factor in the private sector as in state and local government.

What Connecticut employers need—and what our economy and job growth prospects need—is an environment where companies can invest and grow, not a place that becomes more and more unaffordable.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.