New Workplace Mandates Threaten Business Climate

The 2018 legislative session began ominously in February for Connecticut’s business community with the introduction of a host of new high-cost workplace mandates that further threaten the state’s slow job growth.

Many of these proposals are familiar, having failed in previous legislative sessions. Others are new, and all weaken the state’s business climate.

As numerous state rankings show, operating a business in Connecticut is all too often costlier than in other states.

“We’re at a time in Connecticut when we should be unlocking—not restraining—the state’s economic potential,” says CBIA president and CEO Joe Brennan.

“We’re still struggling to regain the jobs lost in the recession and lagging most other states in economic growth, so we should be unleashing the ability of employers to be successful, grow their businesses, and create more jobs.

“Instead, we’re holding them back by proposing new workplace mandates and cost burdens.”

Business Climate Threats

Among the bills that pose the greatest threat to Connecticut’s business climate is a proposed costly paid FMLA program, and another that violates federal law by impinging on employers’ ability to speak freely with their employees.

Other burdensome workplace measures that were still in play at press time include the following:

- Paid sick leave—HB 5044 expands the state’s paid sick leave mandate passed in 2011 from businesses with 50 or more workers to businesses with 20 or more employees, including manufacturers and certain nonprofits, which were previously exempt. The bill also requires companies with fewer than 20 workers to provide unpaid leave. All employees, not just service workers, would be given up to five days of leave annually to care for their own or a child’s illness. HB 5044 also changes the definition of a child from someone under 18 to someone under 26.

- Minimum wage—HB 5388 increases the state’s minimum wage in steps to $15 per hour by 2021 and then calls for automatic annual increases indexed to inflation beginning in 2023. Those annual hikes will equal the percentage increase in the consumer price index—as calculated by the U.S. Bureau of Labor Statistics—for urban wage earners and clerical workers in Connecticut, New York, New Jersey, and Pennsylvania.

- Workplace harassment—SB 132 expands harassment prevention training requirements to businesses with as few as three employees and mandates that training—a two-hour class usually taught by human resources or legal professionals—be provided to all employees, not just supervisors. That means Connecticut companies must train an estimated 1.3 million workers. With per-employee costs ranging from $100 to $150, total private sector compliance costs could exceed $130 million—in addition to the cost of millions of hours of lost productivity. The bill does, however, allow businesses to suspend without pay salaried employees who violate written workplace harassment or violence policies, as they can do now with hourly employees—parity CBIA has long supported to help enforce existing laws related to sexual harassment and violence.

- Credit reports—SB 472 prohibits employers, other than financial institutions, from using credit reports to screen prospective employees who will have access to non-financial assets unless those assets are library or museum collections, or prescription drugs.

Employer Payroll Tax

Another proposal, which was tucked inside one of the bills implementing the governor’s proposed spending revisions for the next fiscal year, would have imposed a new .05% tax on employer payrolls to be used to pay wages and benefits for employees of the Connecticut Department of Labor.

The legislature’s Appropriations Committee failed to act on that budget proposal by its April 5 deadline, but the payroll tax proposal could resurface later in the session.

A second costly measure buried in that budget bill authorized the state to borrow up to $1 million to hire an executive director and pay the legal expenses needed to create the state’s troubled retirement plan mandate.

New workplace mandates represent significant additional costs for every Connecticut business, increase their administrative burdens—or both.

"The workplace mandates approved by legislative committees this year either represent significant additional costs for every Connecticut business, increase their administrative burdens—or both," says CBIA labor and employment policy specialist Eric Gjede.

"That's definitely not the right solution as the rest of the region and the country continue to outperform Connecticut in economic growth and job creation."

Paid FMLA: Costly, Unsustainable

Gjede says that while HB 5387, the paid FMLA mandate "is motivated by good intentions, it's the worst offender in terms of imposing costs and administrative burdens on employers."

The benefit itself is funded through a deduction from employee paychecks, but businesses are required to continue to provide nonwage benefits to employees on leave, and taxpayers will be responsible for funding the program's massive start-up costs.

Last year, a similar proposal was rejected, primarily because of its price tag: $13.6 million to get the program off the ground, and another $18.6 million annually to run it.

The nonpartisan state Office of Fiscal Analysis recently confirmed that the cost of the program would be the same this year.

This year's proposal calls for $20 million in bonding to cover startup costs. Regardless of whether the money eventually comes from bonding or the General Fund, the program saddles taxpayers with the bill.

"I think in a state struggling to find a path toward fiscal sustainability, this is just one more program where the math is so clearly unsustainable that I'm shocked it even came up at all this year," says Gjede.

Small Business Burden

Robin Imbrogno, president and CEO of The Human Resources Consulting Group in Seymour, believes providing workers with paid leave to cover FMLA events is a worthy endeavor, but given the states enormous budget problems, the paid FMLA proposal is a nonstarter.

"Whether the program is funded with a tax on employers or employees, it has to be administered by our state government. I think all of that is impossible right now," says Imbrogno, who provides her 35 employees with short- and long-term disability insurance.

"I just don't think the state is in a financial position to take on any additional burdens, and this would be one of them.

"The program requires more state employees, which everyone is going to pay for at a time when we just can't afford it.

My biggest issue is the fact that it's gone so low in terms of head count to companies that just can't carry those kinds of burdens and, frankly, shouldn't have to.

Imbrogno is also concerned that the bill would impose an untenable burden on small businesses.

"I think my biggest issue is the fact that it's gone so low in terms of head count to companies that just can't carry those kinds of burdens and, frankly, shouldn't have to," she says.

"We need to keep in mind that small businesses are small businesses. They don't have the resources; they don't have staff redundancy; they don't have the ability to train somebody when someone else is out."

No Guaranteed Benefits

Not only would the proposed paid FMLA program be costly to implement and administer, but the calculations that underpin it put it on a fast track to insolvency.

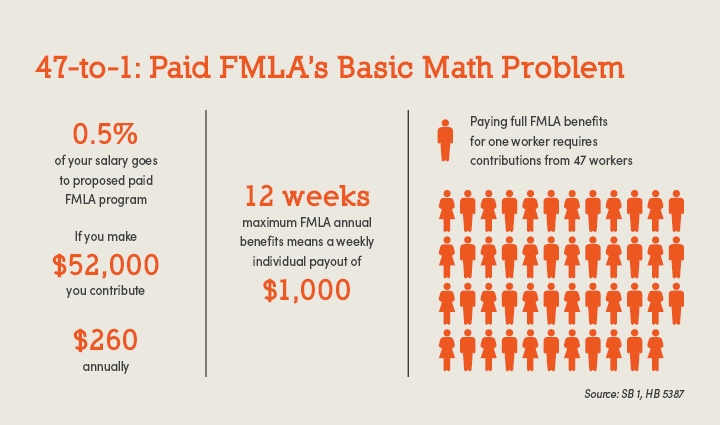

Under the bill, the state takes a percentage of employee wages for deposit into a fund. That fund then covers employees with up to 12 weeks of paid leave at 100% of their pay, capped at $1,000 per week.

Proponents of the bill argue that only 0.5% of workers' pay will be needed to fund the new program—meaning a person earning $52,000 per year contributes just $260 per year into the fund, yet would be eligible to take out $12,000 annually.

The calculations that underpin the paid FMLA mandate will put it on a fast track to insolvency.

By that accounting, the paid FMLA fund faces almost immediate financial collapse.

If the state Department of Labor determines there isn't enough money in the FMLA fund, their solution, says Gjede, is to simply cut weekly benefits to workers.

"So you have employees interested in this program and putting a portion of their paychecks into it but having no clue what they could ever collect from it," he says.

To make matters worse, Gjede argues, the proposal's definition of family—which includes "anyone close to you related by blood, or whose close association…is equivalent of a family member"—is unworkable.

"How does an employer prove that your next-door neighbor who just had a serious medical problem and whom you want to help is not equivalent to a family member to you? It's absurd," he said.

FMLA Mandate Exempts Public Sector

Because of the financial challenges built into the paid FMLA program, its architects decided to take a "do as I say, not as I do" approach, exempting the public sector from the bill.

Proponents of the measure say businesses have a "moral responsibility" to provide paid FMLA to their employees, yet the proposal leaves state and local government workers behind.

"I think the people presenting the bill understand the financial challenge themselves, because they carved state government out of it," says Imbrogno.

"Why is it OK to carve out one group to shift the burden to everyone else? There needs to be consistency in how we manage people, how we manage lives; there needs to be equity."

CBIA believes there are better alternatives to restrictive, unsustainable mandates like the paid FMLA proposal.

With each additional workplace mandate, the cost divide between Connecticut and other states increases.

"As numerous state rankings show, operating a business in Connecticut is all too often costlier than running the same business in other states," he said.

"With each additional workplace mandate, the cost divide between Connecticut and other states increases."

A far better approach to spur much-needed growth, says Gjede, is passing legislation like HB 5584, which provides a tax credit for employers that have paid family and medical leave benefit programs.

Restricting Employer Free Speech

HB 5473, An Act Concerning Captive Audience Meetings, prohibits employers from requiring employee attendance at meetings where any political matter is discussed.

A key problem with the proposal is how broadly it defines "political matters."

Language from the bill states, "Political matters means matters relating to: elections for political office, political parties, legislation, regulation, and the decision to join or support any political party or political, civic, community, fraternal, or labor organization."

This broad definition prevents discussion of almost any business-critical topic without the risk of employees walking out of meetings they're being paid to attend.

"When it comes to the most restrictive bills proposed this session, this one is probably it," says Gjede.

"A lot of our membership is really just offended by this bill."

Gjede notes that the latest version of the bill allows employers to require attendance at meetings where legislation and regulations are discussed, as long as employers can prove the subject matter directly impacts the business. But, he says, there are problems with that too.

"What bill up at the Capitol doesn't have at least some impact on Connecticut businesses? It's all interwoven," says Gjede.

"Take the wages you're paying your employees, for example. Any number of bills under consideration up there could impact what you could offer them in the future.

"So all of these conversations about so-called 'political matters' are connected."

'Trojan Horse'

The stated purpose of HB 5473 is "to prohibit an employer from coercing employees into attending or participating in meetings sponsored by the employer concerning the employer's views on political or religious matters."

Many observers believe, however, that such general language masks the true intent of the bill: to increase the likelihood that union organizing campaigns will succeed by limiting the ability of employers to give employees the company's side of the story.

(Note that "labor organizations"—are referenced only once in the bill, at the very end of the section defining "political matters.")

"I see the bill as a Trojan horse for Big Labor; it's designed to look very benign to folks who might be inclined to vote for it," says Ryan O'Donnell, an associate in the Hartford office of law firm Siegel, O’Connor, O’Donnell & Beck, P.C.

I see the bill as a Trojan horse for Big Labor; it's designed to look very benign to folks who might be inclined to vote for it.

"It's only fair that if unions have the opportunity to spend their campaign speaking freely, there should be a time when employers can have that frank conversation with their employees."

That concept is codified in the National Labor Relations Act, says O'Donnell, which protects employers' right to freedom of speech in union organizing campaigns.

"This bill is trying to take away a right from employers that's enshrined in the NLRA," says O'Donnell. "It clearly runs afoul of the NLRA."

Federal Law Preempts Speech Mandate

That fact was underscored in Connecticut seven years ago when a bill nearly identical to HB 5473 was debated for 11 hours in the state House.

Days later, state Attorney General George Jepsen issued a letter confirming what the Office of Legislative Research and others had already advised: The NLRA preempted the bill.

CBIA and our business allies have been lobbying hard against HB 5473, citing the 2011 Jepsen letter and a legal opinion from a former Clinton appointee to the National Labor Relations Board who said the bill ignores "several decades of federal law on employer free speech rights."

Workplace mandates and cost burdens restrict businesses' ability to compete, invest, and create jobs.

"Such a battle will lead to unnecessary legal costs and burdens on Connecticut," he added, noting that previous attempts by states to override the NLRA either failed or generated NLRB lawsuits against those states.

"The NLRA carved out that right from a freedom of speech perspective and a basic fairness perspective," says O'Donnell.

"Why shouldn't both sides be able to address folks in a non-threatening way during a union organizing campaign? It seems like basic common sense."

Bright Spot: Unemployment Compensation Reform

One encouraging proposal that came out of the Labor and Public Employees Committee this year is HB 5480, which establishes long-overdue reforms to the benefits structure of Connecticut's unemployment compensation system.

The bill is intended to shore up one of the most vital safety nets workers have: the state's Unemployment Trust Fund.

"Unemployment is low in Connecticut, which makes this the perfect time for the legislature to focus on shoring up the fund," says Gjede.

"Although the fund's current balance continues to hover around $400 million, that is far short of its $1.3 billion solvency goal."

The bill's reforms are designed to restore the fund to solvency at no cost to the state and with no cuts in benefits for the average full-time worker who becomes unemployed through no fault of their own.

The reforms are designed to restore the Unemployment Trust Fund to solvency at no cost to the state and with no cuts in benefits for the average full-time worker.

The business community was solely responsible for repaying that debt, and paying back the loan caused the per-employee unemployment tax on Connecticut employers to more than quadruple from $42 to $189.

The federal loan has since been repaid and the tax lowered. But Connecticut must restore the fund to ensure that the need to borrow never happens again.

Neighboring states endured the same recession, yet they were able to restore solvency to their trust funds far more quickly than Connecticut.

"The reason is that they've adopted unemployment benefit reforms to curtail waste and abuse that Connecticut has long refused to adopt," Gjede says.

Restores Trust Fund Solvency

HB 5480 makes the following reforms:

- Requires that employees earn at least $2,000 per year to qualify for benefits

- Freezes the maximum benefit rate in any year in which the unemployment trust fund has not attained 70% solvency

- Requires individuals to exhaust their severance pay before receiving unemployment benefits

- Clarifies that one instance of unexcused absence means one day of no call, no show, not two consecutive days

"These reforms are not draconian cuts; they simply get Connecticut back on par with neighboring states," says Gjede, "and adopting them will help return solvency to our Unemployment Trust Fund and prevent heavy borrowing from the federal government during future recessionary periods."

In fact, a recent review by the Office of Fiscal Analysis determined that the reforms featured in HB 5480 save the fund $70.2 million in the first year, and $93.5 million in the second.

"This is a bill that is absolutely critical to the health of the business community," says Imbrogno, whose company was dramatically impacted by the unemployment tax increases and special assessments imposed to pay back Connecticut's federal loan after the recession.

"It gets back to the difference between business and government. [As a business owner,] you have to create a budget for the year with known factors.

"Companies can't plan with retroactive tax increases because someone else didn't manage our money in a fiscally appropriate way.

"The changes to the unemployment compensation system that are being suggested will help us stay in a place where that fund can be stable.

"We've diluted so much the basis for how unemployment compensation is approved and calculated.

"They have to make that system stable and able to stand independently. The changes that are being identified are critical."

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.